KEY RESEARCH INSIGHTS

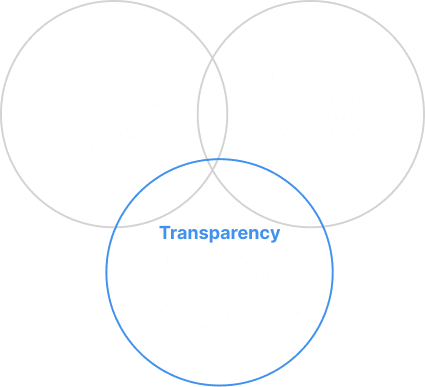

Transparency within the virtual quote flow process makes customers more comfortable sharing personal information.

KEY RESEARCH INSIGHTS

Functionality

Ability to help meet customers needs and goals efficiently.

Why is this information needed?

What is the value of entering this information?

How does this information impact my quote?

Transparency

Tailoring an experience based on information a company has learned about an individual

Personalization

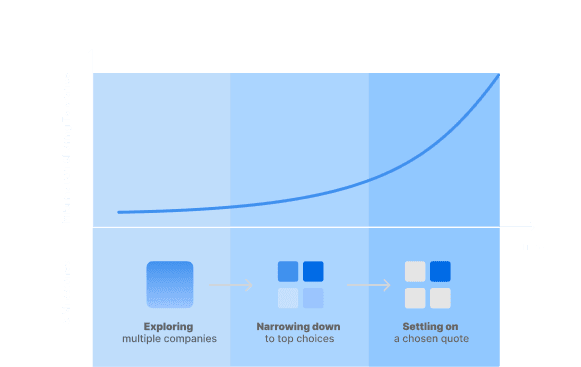

Customers’ tolerance for information sharing depends on where they are in their insurance buying journey.

Insight 3

Customers value an efficient way to share more information to complete a goal.

Insight 2

Insight 1

Throughout the quote flow process, the customer is requested to input many types of information. Whenever additional information or justification is shared, it elicits a sense of autonomy for the customer that leads to more confidence in sharing information to complete the quote.

“It would be really cool if I could understand how this quote came to be, but it’s too complicated to research.”

Customers approach insurance quoting flow with specific goals in mind. Since their motivation to start the quoting flow is often obligatory, they react negatively if there’s anything that comes in the way when they try to get their jobs done, even if it’s discounts. Customers are looking to provide the least amount of information to get the fastest quote.

“I think insurance is a closed industry and that they are trying to hide something”

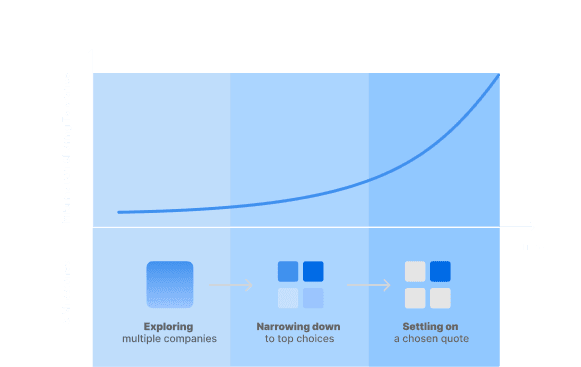

Three decision milestones that shift a user’s tolerance were identified. As a customer advances through each of these stages, their tolerance of sharing information increases at an exponential rate. Their willingness to share additional information is influenced by their perceived value of the outcomes at the end of each stage.

“I would love to skip some questions to get a rough quote. They call you to verify later anyway.”

Currently, Progressive places the most bundling interventions within the quote flow. This is the time when customers are most actively interacting with the digital platform and is considered the most valuable touchpoint. However, there is a mismatch between customer mindset and current bundling interventions.

Translate the life milestones of a consumer to actionable protections they can add on for a more holistic life. Those design interventions are adaptable to where the customer is in their lives to provide them hyper-personalized experience.

There is a mismatch between customer mindset and current bundling interventions.

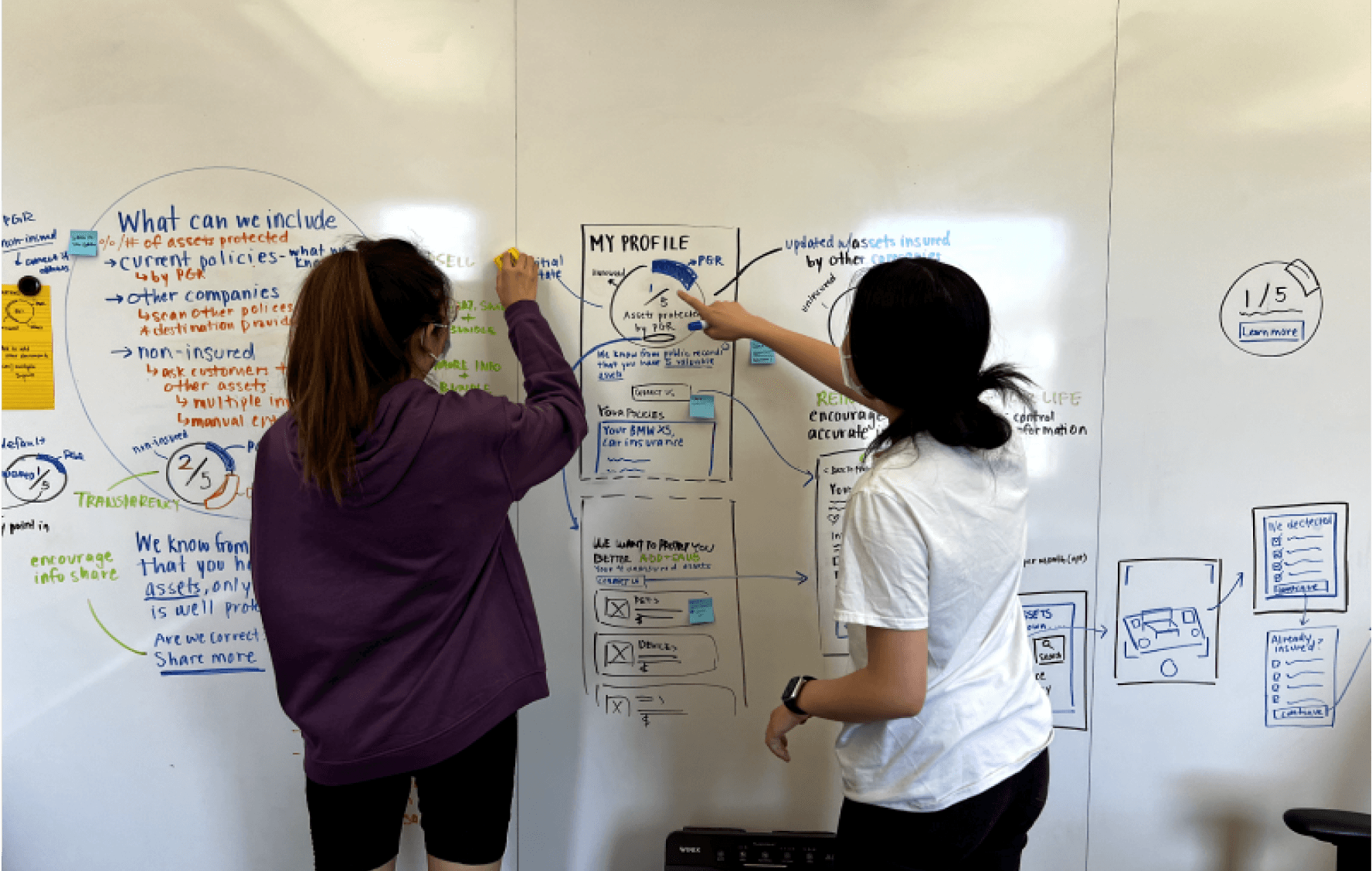

SKETCHING & PROTOTYPING

RELEVANCY

Aim to break the silos of policies and make the quoting experience coherent and seamless across all progressive products. Meanwhile, bringing higher discoverability to Special Line products.

UNIFICATION

Aim to decrease interaction costs and minimize user input to maintain their willingness to share information and bundling motivation. Smart system automation is leveraged whenever possible to cut down the labor times for customers.

PROACTIVITY

Aim to leverage pre-existing mental models of digital shopping experiences that customers have. We utilize familiar design patterns to instill familiarity and increase reliance on customer intuition.

FAMILARITY

MAPPING THE MINDSET

MATCHING THE MINDSET

DESIGN

PRINCIPLES

PROTOTYPING

INTUITIVELY

We observed customers moving through distinct phases of the shopping journey, wherein their goals and motivations changed distinctly. We called these phases shopping, quote finalization, purchasing, and after purchase.

The willingness of customers to share information gradually increases as customers progress through each stage due to their change in mindset and investment throughout their journey. As customers become more committed to a company, they are more comfortable with sharing personal information about themselves.

By considering customer mindset and goals in each stage, we created meaningful interventions to meet customers at the right moment in their journey that encourage a bundling mindset. We considered how the shifts in mindset during each phase changes the willingness to share information to design interventions across each phase.

SHOPPING

QUOTE FINALIZATION

PURCHASING

AFTER PURCHASE

Insurance Journey

Willingness to Share Information

We iterated on our design concepts 6 times across 4 design sprints. Our designs evolved from a low-fidelity prototype to a high-fidelity prototype at the end of all four sprints.

TESTING & VALIDATING

We triangulated across think-aloud testing, design critique and surveys to test our design decisions.

SENSEMAKING & ALIGNING

We synthesized our test results and aligned on which fidelities to test for in the next iteration.

For Progressive, there is a high-value proposition to focus on improving the digital bundling experience for their digital users as they offer several product lines beyond auto insurance. Providing multiple policies to one customer can help Progressive build a deeper relationship, also increasing the lifetime value of the customer.

Progressive wants to provide a comprehensive experience for customers, but can’t do that effectively without more insight into their lives.

We observed that while getting insured, customers skipped several opportunities to bundle because they are goal-oriented and focused on insuring the asset they came here for. When interacting with the current platform, customers find standardized recommendations irrelevant, treating them as blockers and/or ignore them.

Progressive recommends products ineffectively due to mismatched expectations. As a result, most customers overlook bundling opportunities and fail to protect other things they could’ve insured until it’s too late.

Knowing more about customers will help Progressive recommend the right bundles.

PROBLEM

DOMAIN RESEARCH

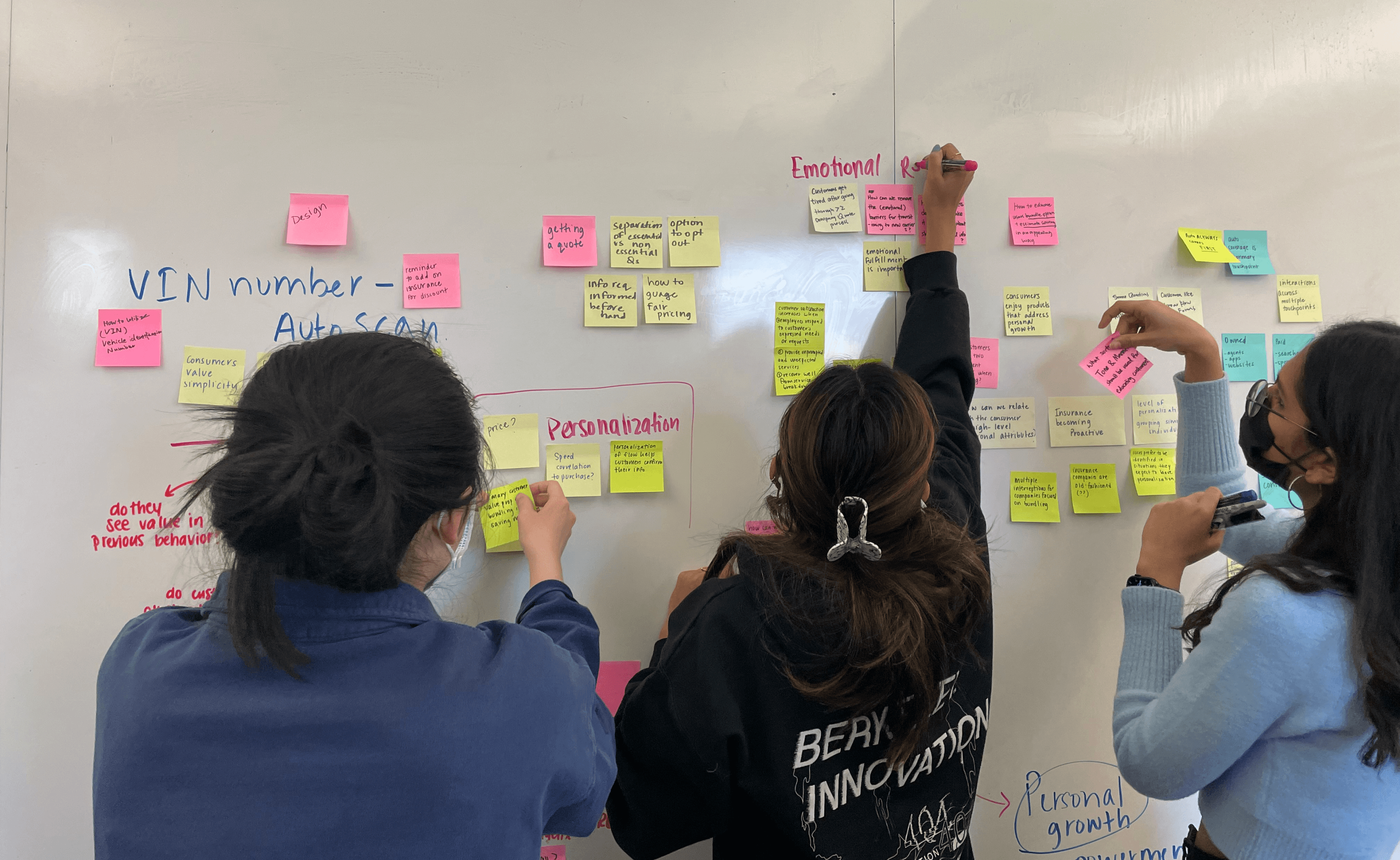

PRIMARY RESEARCH

INITIAL FINDINGS

Competitor Product

Walkthroughs

Interviews with Human-AI Experts

Interviews with Progressive Executives

6

4

6

Weeks of Desk

Research

4

Directed Storytelling

Generative Think Alouds

Semi-Structured Interviews

New emerging ideas were uncovered through domain research, leading to a set of new exploratory questions. While developing these questions we focused on making sure that these questions were broad enough to not restrict ourselves too early in the exploratory research process but also specific enough to give us direction moving forward. We targeted three broad areas for exploration — personalization, education, and seamlessness across siloed product verticals.

To get customers to share valuable information, customer-service agents must build trust and anticipate customer needs.

FINDING 1

FINDING 2

FINDING 3

Insurance is a complex and misunderstood industry.

Personalized experiences improve customer satisfaction and loyalty and differentiate companies.

Human-AI interactions, customer relations, and trust were core to the initial exploration of the insurance problem space. Through a variety of customer experience and market research methods, we assessed different areas of the insurance landscape to gain background and context before talking to our participants.

We immersed ourselves in an in-depth investigation of the lived experience of 10 participants. We attempted to resonate not just with the functional dimensions of insurance purchasing, such as understanding insurance benefits and acquiring one to meet the requirement, but also with the emotional and social ones, especially when insurance is tied closely with personal growth values like empowerment.

home

car

pet

electronic devices

condo

boat

motorcycle

What’s bundled.

What’s not bundled.

snowmobile

RV

umbrella

dental

health

travel

health

vision

wedding

identity theft

AND MORE!

business

This new insurance experience motivates customers to share more about their lives and shifts their mental models by recommending the right multi-product insurance bundles at the right stage of the insurance buying journey.

CHALLENGE

OUTCOME

Progressive wants to provide a comprehensive protective experience for customers, so how might we motivate customers to engage in a holistic bundling experience?

A reimagined insurance experience with personalized and timely interventions to motivate customers to bundle insurance policies. These interventions have taken the form of exploratory copy, quote estimates, relevant recommendations, and implicit reminders about holistic protection.

quote estimates

exploratory copy

relevant recommendations

implicit reminders

Product Designer

UX Researcher

January - August 2022

8 months

1 Project Manager, 2 Product Designers, 2 UX Researchers

Bundling Progressively

ROLE

TIMELINE

TEAM

Reimagining insurance shopping with timely and personalized interventions

Transparency within the virtual quote flow process makes customers more comfortable sharing personal information.

KEY RESEARCH INSIGHTS

Customers’ tolerance for information sharing depends on where they are in their insurance buying journey.

Insight 3

Customers value an efficient way to share more information to complete a goal.

Insight 2

Insight 1

Throughout the quote flow process, the customer is requested to input many types of information. Whenever additional information or justification is shared, it elicits a sense of autonomy for the customer that leads to more confidence in sharing information to complete the quote.

“It would be really cool if I could understand how this quote came to be, but it’s too complicated to research.”

Customers approach insurance quoting flow with specific goals in mind. Since their motivation to start the quoting flow is often obligatory, they react negatively if there’s anything that comes in the way when they try to get their jobs done, even if it’s discounts. Customers are looking to provide the least amount of information to get the fastest quote.

“I think insurance is a closed industry and that they are trying to hide something”

Three decision milestones that shift a user’s tolerance were identified. As a customer advances through each of these stages, their tolerance of sharing information increases at an exponential rate. Their willingness to share additional information is influenced by their perceived value of the outcomes at the end of each stage.

“I would love to skip some questions to get a rough quote. They call you to verify later anyway.”

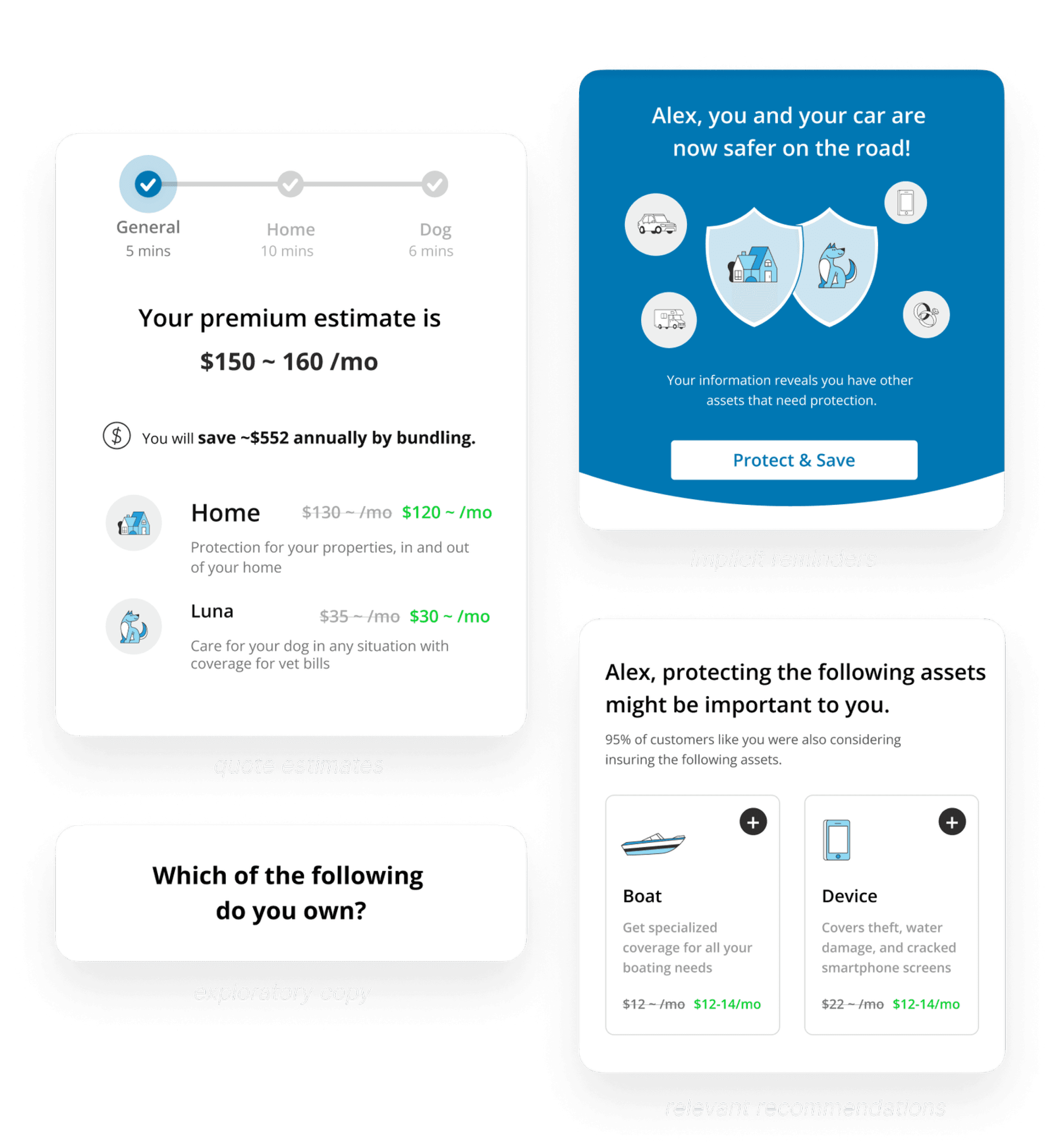

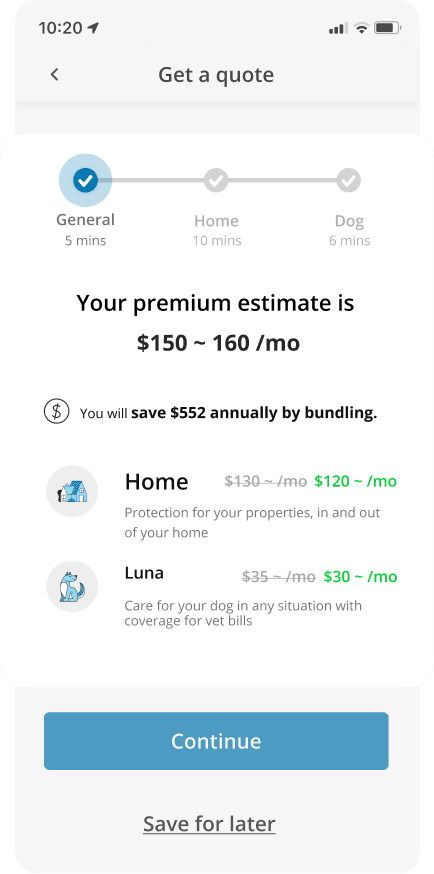

Increasing price transparency to encourage quoting. A smaller range was more incentivizing for customers to continue within the flow to get a final price and coverage options.

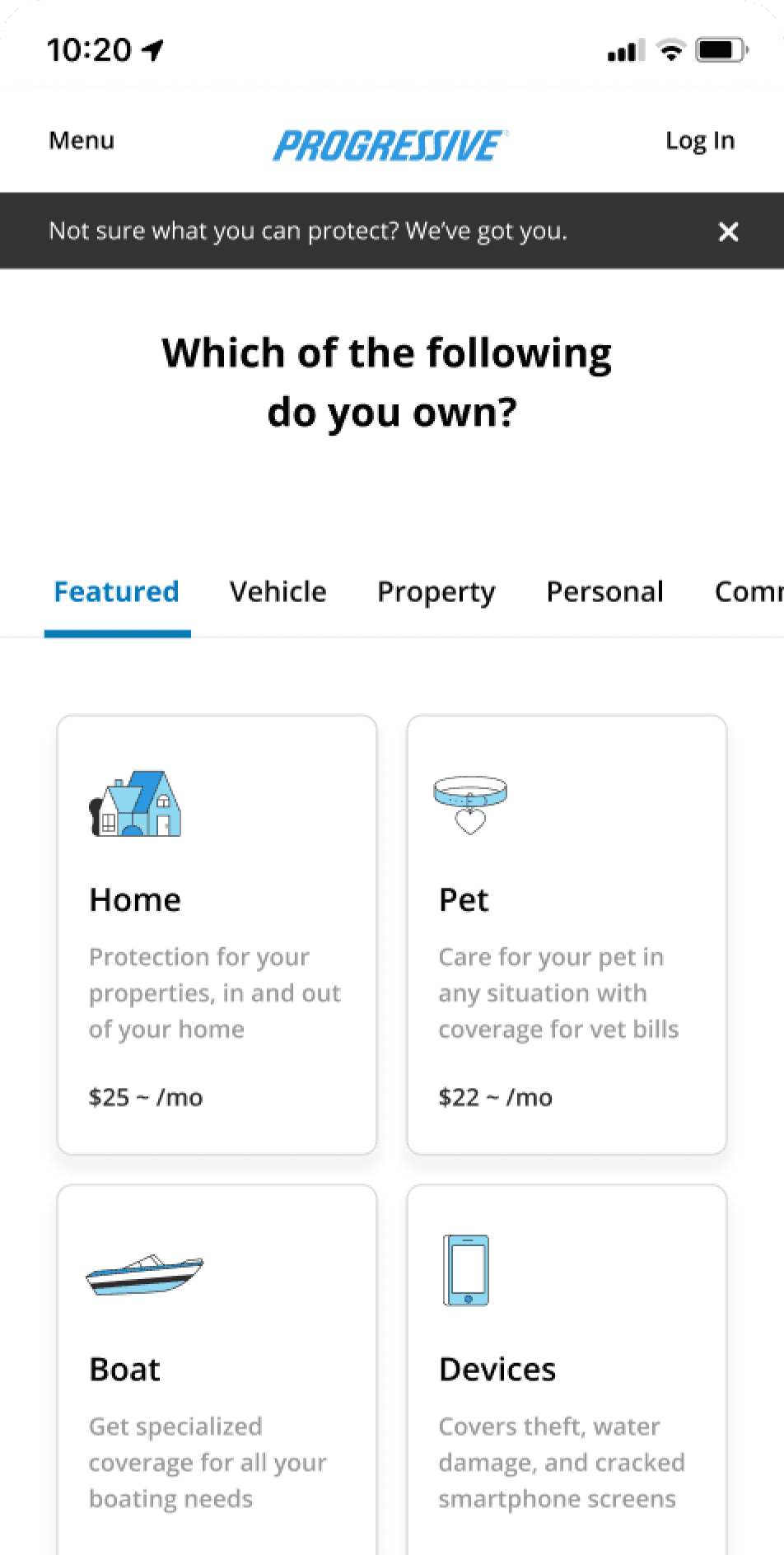

Shifting mindset to help discovery of assets.

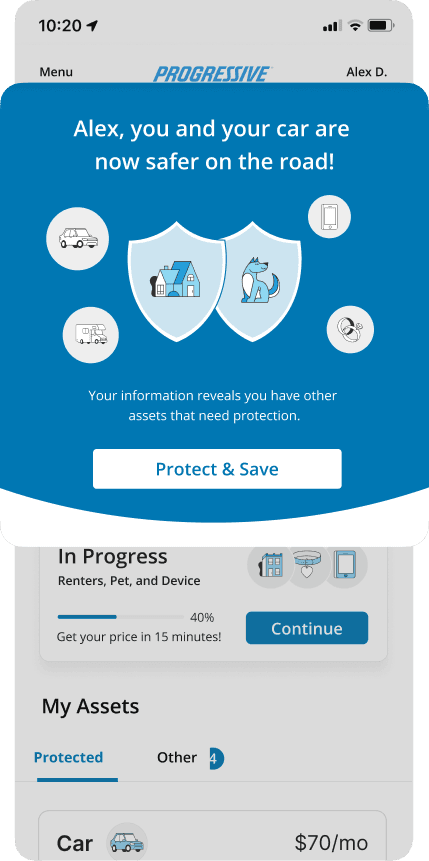

Help customers expand their focus and shift their mindset from policy-oriented to asset-oriented.

DESIGN

OVERVIEW

SHOPPING

Helping customers discover new opportunities and reduce inertia to start insuring multiple products.

QUOTE FINALIZATION

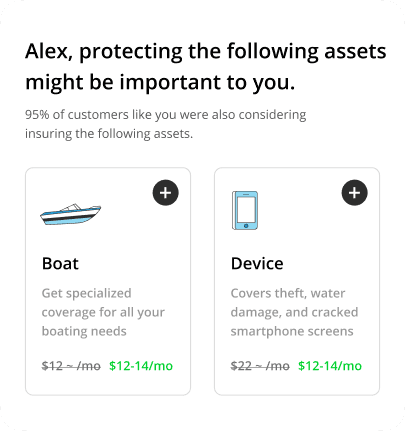

Recommending relevant assets to encourage customers to add more to their current quote.

PURCHASING

Allowing customers to purchase multiple policies together to increase bundling conversion.

PURCHASING

Allowing customers to purchase multiple policies together to increase bundling conversion.

ENCOURAGING

EXPLORATION

Capture attention through educational product cards and product estimates to increase customer engagement and new product discoverability.

Increasing

discoverability

One form irrespective of the number of assets being insured encourages a bundling mindset. Showing quote progress, dynamic estimates and time to completion encourage form completion.

ONE FORM FOR MULTIPLE PRODUCTS

Estimating for MOMENTUM

Before customers move into the next stage of the journey, they are subtly recommended to add additional assets based on the information we have already acquired about the customer from the quote flow.

INTERVENING BEFORE CHECKOUT

Customers are goal-oriented and want a unified experience of purchasing multiple insurance products. When they are in the purchasing phase, customers are looking to quickly check out in one action.

At this point of their insurance journey, customers are not thinking about purchasing new products. We want to emphasize the policies customers already have and use it as an opportunity to present other personalized recommendations.

ONE STOP CHECKOUT

ACTIONABLE REMINDERS ENCOURAGE BUNDLING

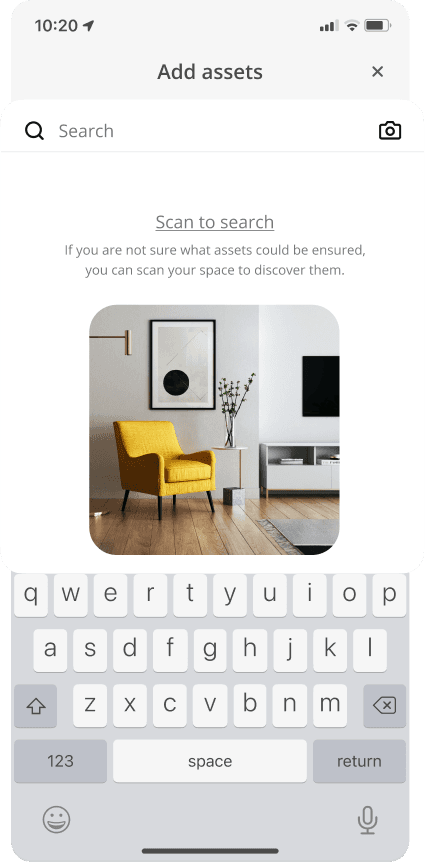

Recognition over recall, leads to quicker discovery. Auto-identifing insurable assets is a quick and easy way that takes the burden off the customers and inserts opportunity to educate through the discovery process.

SCANNING TO DISCOVER

METHODS FOR VALIDATION

USER TESTING

Think-aloud tests with 15 diverse participants for all six design iterations.

DESIGN CRITIQUES

6 rounds of formal design critique with usability experts and industry practitioners.

SURVEY CORROBORATION

A survey with responses from approximately 1,400 Progressive customers.

RESULTS

During each of our 6 rounds of iterative prototyping and testing, we asked each of the 15 participants to tell us how motivated they were to bundle multiple insurance policies on a scale of 1-5. Where 1 is strongly unmotivated and 5 was very motivated. When we mapped what participants answered across the iterations, we saw a significant shift from a majority being in the unmotivated and neutral initially to participants becoming fairly and very motivated by our final iteration.

There was 54% increase in motivation to bundle.

We shifted mindsets.

9/15 participants chose to explore different products when initially coming in to buy car insurance.

12/15 participants said they discovered new products to insure.

12/15 participants added additional products to their quote after reading the personalized recommendations.

We increased motivation.

14/15 participants said their estimates within a $100 range would be encouraging to them.

14/15 participants were more motivated to continue quoting.

81% of survey participants said they would prefer to see an estimate before providing more information.

We unified silos.

15/15 participants were okay with paying more and purchasing multiple policies if they could do it in one purchase.

14/15 participants we tested prefer filling in one form for multiple products.

NEXT STEPS

Over the course of 8 months, we aimed to create a design solution to help Progressive become a destination insurer and help their customers protect more things that they care about. Our research analysis and usability testing results demonstrate we were able to accomplish these goals. To make the proposed design real, there would be merit in conducting further testing and market validation before deployment.

Thus far, design decisions made for this solution have been tested across a diverse set of participants. We acknowledge that the tests we’ve done might not be representative of all customers and can be further validated through large-scale A/B testing with Progressive customers in the future.

FURTHER VALIDATION

We believe working on technical feasibility beyond the initial discussions we’ve had so far will help create a roadmap for the direction this project takes in the future.

TECHNICAL FEASIBILITY